Global air cargo demand and rates edged further upwards in the first full week of February, with freighter capacity from Central & South America (CSA) returning to normal as flower shipments had already peaked ahead of Valentine’s Day on 14 February, while carriers and forwarders also lowered capacity from parts of Greater China due to the start of factory closures and slowdowns ahead of Lunar New Year (LNY) on 17 February.

Global air cargo demand and rates edged further upwards in the first full week of February, with freighter capacity from Central & South America (CSA) returning to normal as flower shipments had already peaked ahead of Valentine’s Day on 14 February, while carriers and forwarders also lowered capacity from parts of Greater China due to the start of factory closures and slowdowns ahead of Lunar New Year (LNY) on 17 February.

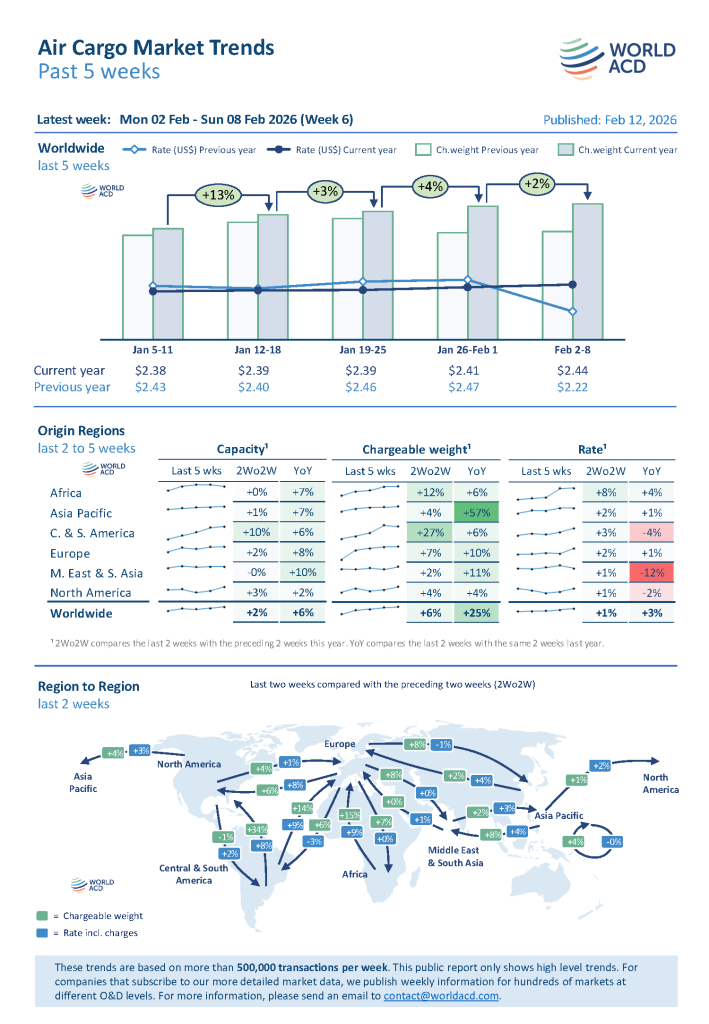

According to the latest weekly figures and analysis from WorldACD Market Data, global chargeable weight in week 6 (2 to 8 February) rose by a further +2%, week on week (WoW) – the fifth consecutive WoW tonnage increase following the annual year-end slump. It was a mixed picture globally in week 6, with tonnages from North America rebounding strongly with a +8% WoW increase, as capacity returned due to the easing of the winter storms that had caused cuts to air services across parts of the continent. Traffic from the Middle East & South Asia (MESA) also recorded a strong (+7%) WoW increase, partly due to disruptions to flights in parts of the region in the weeks before due to mounting tensions between the US and Iran.

According to the latest weekly figures and analysis from WorldACD Market Data, global chargeable weight in week 6 (2 to 8 February) rose by a further +2%, week on week (WoW) – the fifth consecutive WoW tonnage increase following the annual year-end slump. It was a mixed picture globally in week 6, with tonnages from North America rebounding strongly with a +8% WoW increase, as capacity returned due to the easing of the winter storms that had caused cuts to air services across parts of the continent. Traffic from the Middle East & South Asia (MESA) also recorded a strong (+7%) WoW increase, partly due to disruptions to flights in parts of the region in the weeks before due to mounting tensions between the US and Iran.

Tonnages from CSA origins began subsiding (-4%, WoW) in week 6 following the +24% WoW spike in chargeable weight the previous week, as the pre-Valentine’s Day surge passed its peak, during which hundreds of freighter flights transported thousands of tonnes of flowers from Colombia and Ecuador to Miami and Los Angeles and other hubs in North America, an annual epic logistical operation.

Tonnages from Asia Pacific origins also edged up in week 6 by a further +1%, WoW, although they were flat to both the US and to Europe, based on the more than 500,000 weekly transactions covered by WorldACD’s data. WoW increases in traffic to the US from Japan (+11%), Hong Kong (+6%), and China (+2%) were neutralized by decreases from South Korea (-16%), Vietnam (-10%), and other parts of Southeast Asia. Meanwhile, on the pricing side, further spot rate rises from China to the US (+6%, WoW, to US$4.69 per kilo), and small rises from Hong Kong and parts of Southeast Asia, were wiped out by WoW falls in spot prices from Japan (-10%) and South Korea (-14%).

Within the stable tonnages from Asia Pacific origins to Europe as a whole, chargeable weight from Taiwan to Europe rose (+6%, WoW) for the fifth consecutive week following their year-end drop, and there was a further strong increase from Vietnam to Europe (+10%, WoW). But from China, tonnages were flat, and there were WoW falls in volumes from Japan and South Korea. Average spot rates from Asia Pacific origins to Europe recorded their third successive WoW small gain (+2%), thanks mainly to a continuing rebound in spot prices from China (+6%, WoW, to $4.09 per kilo).

Within the stable tonnages from Asia Pacific origins to Europe as a whole, chargeable weight from Taiwan to Europe rose (+6%, WoW) for the fifth consecutive week following their year-end drop, and there was a further strong increase from Vietnam to Europe (+10%, WoW). But from China, tonnages were flat, and there were WoW falls in volumes from Japan and South Korea. Average spot rates from Asia Pacific origins to Europe recorded their third successive WoW small gain (+2%), thanks mainly to a continuing rebound in spot prices from China (+6%, WoW, to $4.09 per kilo).

The strong (+7%) WoW increase in tonnages from MESA origins in week 6 was particularly pronounced to the US, where chargeable weight surged by +12%, driven largely by growth in volumes from Dubai, India and Bangladesh. A +20% WoW rise from Dubai to the US followed a -26% fall the previous week, linked to flight restrictions due to the tensions between the US and Iran. A +14% WoW rise from India to the US also followed a -8% dip the previous week. But the +17% increase from Bangladesh origins to the US follows a +10% increase the previous week, part of a strong rebound since the start of this year.

Tonnages from MESA origins to Europe also rose quite strongly (+6%, WoW) in week 6, although there has been considerable volatility in recent weeks in this market that make it difficult to determine any clear patterns.

North America’s air cargo markets experienced major turbulence last year. Wider analysis by WorldACD indicates that total combined air cargo tonnages to and from North America grew by +2.5% in 2025, with the US market – which makes up almost 90% of that figure – up by +2.6%, and Canada tonnages up by around +8%, while Mexico demand fell by almost -5%, year on year (YoY). Inbound and outbound growth was similar for North America as a whole, up +2.6% and +2.3%, respectively, with the US showing similar rates of +2.8% inbound and +2.2% outbound. But for Mexico, there was a big gap between the performance of inbound (-6%, YoY) and outbound (-1%) traffic, as was also the case for Canada (+9% inbound; +6% outbound), according to WorldACD’s data. That compares with +9% YoY growth in inbound tonnages for North America as a whole in 2024, and +4% outbound growth.

The patterns of 2025 appear to have broadly continued into 2026, with the region as a whole recording a further tonnage rise of +2.7%, YoY, in January. However, the severe winter storms that affected parts of the US and Canada in recent weeks may have impacted this year’s figures to some extent – particularly outbound tonnages from Canada, which in January were down by almost -7%, YoY. Another figure that was significantly different was the performance of the Mexico market, with last year’s full-year -5% decline reversed in January, becoming a +5% YoY increase. That was mostly driven by a +14% rise in outbound tonnages, with inbound volumes recording only a modest (+1.5%) YoY increase.

![A*STAR, SIA & SIAEC sign deals for cabins, AI [Press Release] A STAR SIA & SIAEC Deepen Partnership with Two Joint Labs to Advance Aircraft Cabin Component Manufacturing and AI For Enhanced Airline Operations](https://asianaviation.com/wp-content/uploads/Press-Release-A-STAR-SIA-SIAEC-Deepen-Partnership-with-Two-Joint-Labs-to-Advance-Aircraft-Cabin-Component-Manufacturing-and-AI-For-Enhanced-Airline-Operations-218x150.jpg)

![A*STAR, SIA & SIAEC sign deals for cabins, AI [Press Release] A STAR SIA & SIAEC Deepen Partnership with Two Joint Labs to Advance Aircraft Cabin Component Manufacturing and AI For Enhanced Airline Operations](https://asianaviation.com/wp-content/uploads/Press-Release-A-STAR-SIA-SIAEC-Deepen-Partnership-with-Two-Joint-Labs-to-Advance-Aircraft-Cabin-Component-Manufacturing-and-AI-For-Enhanced-Airline-Operations-100x70.jpg)